Updated on 29th April 2025

Pay and file deadline for Self-employed’s Income tax (for the year 2024) is 31st October 2025.

If you file your tax return and pay tax online (through ROS – Revenue Online System), the deadline is extended till 19th November 2025.

You need to do both steps to get extended deadline (19th November), file (your tax return) and pay (Income tax).

What you need to do:

- File your Income tax return 2024,

- Pay Income tax balance due for 2024,

- Pay Preliminary tax for 2025 (the same amount as your income tax for 2024).

If you have any problems with ROS system, you can contact ROS Helpdesk at +353 1 738 3699, email roshelp@revenue.ie or through ROS -> MyEnquiries: Submit an enquiry selecting the headings: “Other than the above” -> “Revenue Online Service (ROS) Technical Support”. You can also chat with Iris on the ROS Login screen to get help with ROS login issues.

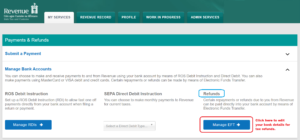

Payments and Refunds

The Revenue will no longer issue cheques refunds of Income Tax for mandatory e-filers. If you are in a tax refund position, you will need to ensure that your bank account details are saved in ROS refund section and are up to date. Please login to ROS and on the My Services page go to Manage Bank Accounts and select Manage EFT in the Refunds section.

You can make payment of your income/preliminary tax by ROS Debit Instructions (RDIs), Laser Card, Debit Card, Credit Card.

You can pay taxes due by Electronic Funds Transfer (EFT) if you are either: a non-resident, and do not have a SEPA reachable bank account or a customer who is exempt from mandatory electronic filing and payment. Use the following Revenue account to make your EFT payment.

If you do not have an active ROS digital certificate and an Agent is submitting a return on your behalf, you can now make an online payment for Income Tax through myAccount. You can register for myAccount on the Revenue website.

If you need assistance with making payments on ROS, you can contact the Collector General’s Division on (01) 738 3663 or through ROS -> MyEnquiries: Submit an enquiry selecting the headings: “Other than the above” -> ” Revenue Online Service (ROS) Payments”.

For assistance filing an Income Tax Form 11, please forward your query through MyEnquiries. Select ‘Add a new Enquiry’ and then ‘Income Tax’ and the appropriate sub category from the dropdown options available. Alternatively, you can contact the Business Taxes helpline on (01) 738 3630 with your tax query.

I recommend you to pay and file your tax return before 31st October deadline. The closer to the deadline the heavier traffic will be in ROS system and ROS might not work as you would expect. System can be slowly or in worst can be down and you wouldn’t be able to file and pay on time.

When you file your tax return form early, it will not result in Revenue seeking payment of tax early. You can pay your tax liability by 31st October.

Surcharge

If you file your Income tax return late, a surcharge will be added on to your tax due, as follows:

• if you missed the deadline of 31/10/2025 (or 19/11/2025 for ROS customers) and you file your tax return before 31st December 2025, there is extra penalty of 5% of the tax due (maximum of €12,695), for example if your final tax bill is €800, a surcharge of €40 (800 x 0.05) is added to the bill with total to pay €840.

• if you file your tax return after 31st December 2025, there is extra penalty of 10% of the tax due (maximum of €63,485), for example if your final tax bill is €800, a surcharge of €80 (800 x 0.10) is added to the bill with total to pay €880.

Extended support opening hours

|

Date |

ROS Technical Helpdesk 01-7383699 |

Business Taxes (Income Tax only) 01-7383630 |

Collector General’s Division (including ROS Payment Support) 01-7383663 |

|

Thursday, 13 November 2024 |

09.00 – 17.00 |

09.30 – 17.00 |

9:30 – 13:30 |

|

Friday, 14 November 2023 |

09.00 – 20.00 |

09.30 – 20.00 |

09.00 – 20.00 |

|

Monday, 17 November 2023 |

09.00 – 20.00 |

09.30 – 20.00 |

09.00 – 20.00 |

|

Tuesday, 18 November 2024 |

09.00 – 20.00 |

09.30 – 20.00 |

09.00 – 20.00 |

|

Wednesday, 19 November 2024 |

09.00 – 24.00 |

09.30 – 24.00 |

09.00 – 20.00 |

Online help is available on the Revenue website :

Completing your Income Tax return

Other helpful links:

Revenue Guide to Completing Pay and File Tax Returns

Source: www.Revenue.ie, Revenue eBrief No. 88/25, Revenue eBrief No. 248/24